JP Morgan and Bank of America agree: Drop in Greek bank profits in Q3, but still on target

Market focus will shift to growth strategies in bancassurance and 2025 dividend payout forecasts for Greek banks.

Analysts at JP Morgan and Bank of America remain positive about the outlook for Greek banks, despite the expected mild decline in net interest income (NII) during the third quarter of 2025.

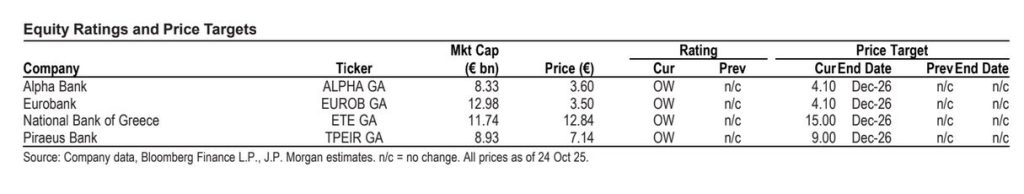

JP Morgan projects that the trend for the sector remains positive, maintaining target prices at €4.10 for Alpha Bank and Eurobank, €15 for National Bank of Greece, and €9 for Piraeus Bank.

Analysts expect investor attention to focus on growth strategies in bancassurance and dividend distribution forecasts for 2025, with National Bank, Eurobank, and Alpha Bank showing the greatest upside potential.

Bank of America, meanwhile, is raising its target prices, placing special emphasis on Eurobank, which it expects to deliver the strongest returns, while closely monitoring developments in the M&A sector, particularly after Eurobank’s acquisition of Eurolife.

Bank of America forecasts that loan volumes will remain subdued in the third quarter, with growth expected mainly in the fourth quarter. It also notes that Q3 may not mark the low point for NII, as initially anticipated.

Despite challenges in the mortgage loan sector, BofA expects a recovery between 2027 and 2028, with Piraeus Bank likely to post positive growth for the first time in over a decade.

Both major U.S. banks agree that, despite seasonality and structural challenges, strategic moves in bancassurance and dividend momentum will continue to support the sector’s positive outlook.

No surprises expected

With Q3 2025 earnings reports just around the corner, JP Morgan analysts estimate that Greek banks are unlikely to deliver any major surprises.

Despite the expected minor decline in NII for the third quarter, the market appears to have already priced in these developments, with valuations reflecting current performance.

JP Morgan remains overweight on the sector, expecting returns above market averages.

Target prices remain at €4.10 for Alpha Bank and Eurobank, €15 for National Bank of Greece, and €9 for Piraeus Bank.

It should be noted that Piraeus Bank has not recently issued updated target prices, as previous estimates had been withdrawn.

A mild quarter

Analysts expect the third quarter to be generally mild for Greek banks, with NII declining by less than 1% compared to the previous quarter—except for Alpha Bank, which is expected to post an increase of around 1%.

This small decline is mainly attributed to the delayed repricing of assets, while loan volume growth and a reduction in deposit costs are expected to partially offset the losses.

Despite seasonal weakness in lending volumes, analysts see a positive trajectory for Greek banks, with much of this optimism already reflected in market prices.

Expansion into bancassurance

Particular attention is expected to focus on two key areas: developments in bancassurance and 2025 dividends.

Eurobank, having recently completed the acquisition of Eurolife, is expected to announce further insurance-related partnerships, while National Bank of Greece is reportedly planning new strategic initiatives, potentially involving partnerships or minority stakes.

Piraeus Bank, for its part, is expected to continue its bancassurance expansion, with potential new announcements ahead.

As for dividends, estimates suggest that National Bank of Greece will lead with a payout ratio of around 60–70%, while Eurobank and Alpha Bank are expected to maintain dividend yields near 60%.

Piraeus Bank, on the other hand, is projected to distribute around 50%.

These estimates underscore the sector’s overall financial health and the ability of Greek banks to return capital to shareholders.

Target price increases

Bank of America has slightly raised its target prices for Greek banks, focusing primarily on Eurobank, which it expects to deliver the strongest return (+38%), raising its target from €4.45 to €4.64.

Alpha Bank and National Bank of Greece also see smaller upward revisions, while Piraeus Bank’s target rises from €7.78 to €8.01.

BofA maintains a neutral rating on National Bank but continues to recommend buying the other three lenders.

It expects that the third quarter may not mark the NII trough, as previously estimated, with a full recovery more likely in the fourth quarter.

Loan growth is expected to remain limited in Q3, given that July and August are traditionally weak months.

However, BofA anticipates a stronger performance in Q4, with Piraeus Bank and Eurobank likely to post the highest loan growth.

The Greek M&A market is expected to heat up in Q4, with Eurobank completing its acquisition of 80% of Eurolife Life, and other potential mergers or acquisitions on the horizon.

BofA is monitoring these developments closely, noting that ROTE growth driven by M&A could boost shareholder value, even without immediate synergies.

Mortgage loans back on the table

The recovery of the mortgage loan sector is expected to be a key discussion point for Q3 and the 2026–2027 period, with Piraeus Bank projected to record positive growth in mortgages for the first time in over a decade.

However, BofA cautions that structural issues related to affordability and credit scoring among Greek households will take longer to resolve.

Overall, the outlook for Greek banks remains positive despite short-term challenges.

Strategic moves in bancassurance and potential M&A activity remain the main growth drivers, while dividend expectations and capital distributions continue to paint an encouraging picture for the sector.

www.bankingnews.gr

Οι απόψεις που εκφράζονται στα σχόλια των άρθρων δεν απηχούν κατ’ ανάγκη τις απόψεις της ιστοσελίδας μας, το οποίο ως εκ τούτου δεν φέρει καμία ευθύνη. Για τα άρθρα που αναδημοσιεύονται εδώ με πηγή, ουδεμία ευθύνη εκ του νόμου φέρουμε καθώς απηχούν αποκλειστικά τις απόψεις των συντακτών τους και δεν δεσμεύουν καθ’ οιονδήποτε τρόπο την ιστοσελίδα.